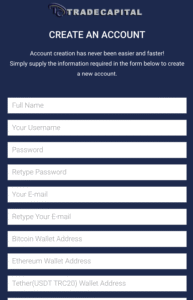

Website: tradecapitallimited.org

Trade capital limited has recently appeared in the online trading space, presenting itself as a professional investment platform. However, a growing number of consumer reports and a lack of verifiable regulatory information have raised significant concerns. This review outlines the key findings consumers should consider before engaging with the platform.

Is Trade capital limited Regulated?

One of the most important factors in evaluating any trading platform is its regulatory status. Trusted online brokers typically operate under licences issued by well-known financial authorities such as:

- FCA – Financial Conduct Authority (UK)

- SEC – Securities and Exchange Commission (US)

- ASIC – Australian Securities and Investments Commission

- CySEC – Cyprus Securities and Exchange Commission

A review of available regulatory databases did not identify any licence or authorisation for Trade capital limited.

This absence of oversight means:

- No guaranteed protection of client funds

- No structured dispute-resolution mechanisms

- Limited accountability if problems occur

For consumers, this is a significant risk factor.

What Users Have Reported

Multiple consumers have submitted complaints or warnings about their experiences with Trade capital limited. The most common issues include:

- Withdrawal requests not being processed

- Unexpected fees or “taxes” being requested before releasing funds

- Persistent requests to deposit more money

- Difficulty obtaining support or clear information

- Unverified claims about regulation or company legitimacy

While individual cases may vary, the pattern of reports suggests that users should approach the platform with caution.

Operational Concerns Identified

In addition to user submissions, a review of the platform highlights several red flags typically associated with high-risk trading services:

- No publicly verifiable company ownership or management details

- Claims of high or guaranteed profits

- Limited transparency regarding how trades are executed

- Reports of accounts being frozen or restricted

- Additional fees introduced during withdrawal attempts

These factors make it difficult for consumers to independently verify the legitimacy of the service.

What You Should Do if You’re Affected

If you have deposited funds with Trade capital limited and are encountering issues such as blocked withdrawals or unresponsive support take action promptly:

- Stop sending additional money to the platform.

- Contact your bank or card provider to request a chargeback or dispute the transaction.

- Save all documentation, including payment receipts, chat logs, and screenshots.

- Report the issue to your local financial regulator or cybercrime authority.

- Submit your case to LINCOX RECLAIM through the Report a Scam portal for a free consultation and case assessment.

LINCOX RECLAIM provides structured guidance for individuals seeking assistance with documenting losses and exploring potential recovery options.

Conclusion: Consumers Should Exercise Extreme Caution

Based on user complaints, lack of regulatory licensing, and concerns regarding transparency, Trade capital limited presents a high-risk profile for investors. Until the platform can demonstrate verified regulation and reliable business practices, consumers are strongly advised to avoid depositing funds.

If you have already been affected, taking immediate steps to document your case and seek assistance may improve your chances of recovery.